Average industry glide paths “should reasonably meet the typical worker's spending needs in retirement.”

Something of a hedge in confidence for a product that continues to generate controversy, but a report released Thursday from Morningstar details where target-date funds reside in their industry development.

The report, “Target-Date Series Research Paper: 2013 Industry Survey,” finds target-date series have become “established fixtures in defined contribution plans: assets are rising, fees are falling, and performance reflects strong broad market trends.”

It notes more target-date assets are shifting to passively managed investments, as both an underlying holding within a portfolio and as an overall investment approach. While 68% of target-date assets were in actively managed series as of Dec. 31, inflows to passively managed series—those that invest 80% or more in passively managed investments—surpassed flows into actively managed series for the first time for the 2012 calendar year.

Top 10 Paper Companies To Buy For 2015: Boise Inc (BZ)

Boise Inc., incorporated on February 1, 2007, is a manufacturer of packaging and paper products, including corrugated containers and sheets, containerboard, protective packaging products, imaging papers for the office and home, printing and converting papers, label and release papers, newsprint and market pulp. The Company operates in the United States, Europe, Mexico, and Canada. The Company operates in three segments: Packaging, Paper, and Corporate and Other. The Company�� newsprint is sold primarily to newspaper publishers in the southern and southwestern the United States. During the year ended December 31, 2012, approximately 38% of the Company�� uncoated freesheet paper was sold to OfficeMax Incorporated, its customer.

Packaging

In the Packaging segment, the Company manufactures and sells linerboard, containerboard, corrugated containers and sheets, protective packaging products, and newsprint. Linerboard is a paperboard, which when combined with corrugating medium is used in the manufacture of corrugated sheets and containers. Corrugated sheets are containerboard sheets that are sold primarily to converters that produce a variety of corrugated products. Corrugated containers are corrugated sheets that have been fed through converting machines to create containers, which are used in the packaging of fresh fruit and vegetables, processed food, beverages, and other industrial and consumer products. Stock boxes are corrugated containers manufactured to pre-set dimensions.

Protective packaging products include multi-material customized packaging solutions, which may utilize kraft paper-based honeycomb corrugated packaging, foamed plastics, and air pocket packing materials Newsprint is a paper commonly used for printing newspapers, other publications, and advertising material. During the year ended December 31, 2012, its Packaging segment produced approximately 613,000 short tons of linerboard, and its Paper segment produced approximately 135,000 short tons! of corrugating medium. It manufactures linerboard and newsprint on two machines at its mill in DeRidder, Louisiana. It also manufactures corrugated containers and sheets and protective packaging products at 26 plants located in North America and Europe.

Paper

In its Paper segment, the Company manufactures and sells three general categories of products: communication-based papers; packaging-based papers, and market pulp. Its communication-based papers include cut-size office papers, and printing and converting papers. Its Packaging-Demand-Driven Papers include Label and release papers, Flexible packaging papers, and Corrugating medium. Printing and converting papers are used by commercial printers or converters to manufacture envelopes, forms, and other commercial paper products.

Its packaging-based papers include label and release papers and corrugating medium. The Label and release papers include label facestocks, as well as release liners. The coated and uncoated papers sold to customers create packaging products for food and nonfood applications. Market pulp is sold to customers in the open market for use in the manufacture of paper products. The Company manufactures its Paper segment products at three mills, all located in the United States.

Corporate and Other

The Company�� Corporate and Other segment includes transportation assets, such as rail cars and trucks, which it uses to transport its products from its manufacturing sites. The Company provides transportation services not only to its own facilities but also, on a limited basis, to third parties. Rail cars and trucks are typically leased.

The Company competes with International Paper Company, Rock-Tenn Company, Georgia-Pacific LLC, Packaging Corporation of America, Longview Fibre Paper, Packaging, Inc, Green Bay Packaging Inc., KapStone Paper, TexCorr, L.P., Resolute Forest Product, SP Newsprint Co. and Domtar Corporation.

Advisors' Opinion: Top 10 Paper Companies To Buy For 2015: Vidrala SA (VID)

Vidrala SA is a Spain-based company principally, which is engaged in the glass industry. The Company�� activities include the production, distribution and sale of glass bottles and containers used in the food and beverages industries. The Company conducts its own research and development (R&D) operations. It operates six production plants and 12 melting furnaces located in such countries, as Portugal, France, Belgium and Italy. As of December 31, 2011, the Company owned such subsidiaries as Crisnova Vidrio SA, Inverbeira Sociedad de Promocion de Empresas SA, Gallo Vidro SA, Castellar Vidrio SA, Corsico Vetro SRL, MD Verre SA, Omega Immobiliere et Financiere SA, Investverre SA and CD Verre SA.

Berry Plastics Group, Inc. (Berry), incorporated on November 18, 2005, is a provider of plastic consumer packaging and engineered materials. Berry owns 100% interest of Berry Plastics Corporation. Berry sells its solutions predominantly into end markets, such as food and beverage, healthcare and personal care. The Company operates in three segments: Rigid Packaging, Engineered Materials and Flexible Packaging. As of September 19, 2012, the Company supplied its customers through 82 manufacturing facilities throughout the United States (68 locations) and select international locations (14 locations). In June 2012, the Company acquired 100% interest of Frans Nooren Beheer B.V. and its operating companies (Stopaq). In September 2011, the Company acquired 100% interests of Rexam Closures Kentucky Inc., Rexam Delta Inc., Rexam Closures LLC, Rexam Closure Systems LLC, Rexam de Mexico S. de R.L. de C.V., Rexam Singapore PTE Ltd., Rexam Participacoes Ltda. and Rexam Plasticos do Brasil Ltda. (collectively, Rexam SBC). In August 2011, Berry acquired 100% interest of LINPAC Packaging Filmco, Inc.

Rigid Packaging

The Company�� Rigid Packaging business consists of containers, foodservice items, house wares, closures, over caps, bottles, prescription vials, and tubes. The end uses for these products are consumer-oriented end markets, such as food and beverage, retail mass marketers, healthcare, personal care and household chemical. The Company manufactures a collection of container products. The Company produces 32 ounce or thermoformed polypropylene (PP) drink cups and offers a product line with sizes ranging from 12 to 52 ounces. The Company�� products of house wares market is focused on producing semi-disposable plastic home and party and plastic garden products. The Company produces closures and over caps across several of its product lines, including continuous-thread and child-resistant closures, as well as aerosol over caps. The Company also provides a range of custom closu! ! re solutions including fitments and plugs for medical applications, cups and spouts for liquid laundry detergent, and dropper bulb assemblies for medical and personal care applications.

The Company competes with Airlite, Letica, Polytainers, Silgan, Aptar Group and Reynolds.

Engineered Materials

Berry�� Engineered Materials business primarily consists of pipeline corrosion protection solutions, specialty tapes and adhesives, polyethylene-based film products, and can liners served to a variety of end markets including oil, water and gas infrastructure, industrial and consumer-oriented end markets. The Company produces anti-corrosion products to infrastructure, rehabilitation and pipeline projects throughout the world. Products include heat-shrinkable coatings, single- and multi-layer sleeves, pipeline coating tapes, anode systems for cathodic protection and epoxy coatings. These products are used in oil, gas and water supply and const ruction applications.

Berry is the manufacturer of cloth and foil tape products. Other tape products include range of splicing and laminating tapes, flame-retardant tapes, vinyl-coated and carton sealing tapes, electrical, double-faced cloth, masking, mounting, original equipment manufacturer (OEM) medical and specialty tapes. These products are sold under the National, Nashua and Polyken brands in the United States. The Company manufactures and sells a portfolio of PE-based film products to end users in the retail markets. These products are sold under brands, such as Ruffies and Film-Gard. Its products include drop cloths and retail trash bags. The Company manufactures customized PP-based, woven and sewn containers for the transportation and storage of raw materials, such as seeds, titanium dioxide, clay and resin pellets.

The Company offers range of polyvinyl chloride (PVC) meat film and agricultural film. Berry�� products are used primarily to wrap fresh meats, poultry and produce for supermarket ! app! lica! tions! . In addition, the Company offers a line of boxed products for food service and retail sales. Berry sells trash-can liners and food bags for offices, restaurants, schools, hospitals, hotels, municipalities and manufacturing facilities. The Company also sells products under the Big City, Hospi-Tuff, Plas-Tuff, Rhino-X and Steel-Flex brands. The Company produces both hand and machine-wrap stretch films, which are used by end users to wrap products and packages for storage and shipping. It sells stretch film products to distributors and retail and industrial end users under the MaxTech and PalleTech brands.

The Company competes with AEP, Sigma and 3M.

Flexible Packaging

The Company�� Flexible Packaging business consists of barrier, multilayer film products, as well as finished flexible packages, such as printed bags and pouches. Berry manufactures and sells a range of film products ranging from mono layer to coextruded films having up to nine layers, lamination films sold primarily to flexible packaging converters and used for peelable lid stock, stand-up pouches, pillow pouches and other flexible packaging formats. The Company also manufactures barrier films used for cereal, cookie, cracker and dry mix packages that are sold directly to food manufacturers like Kraft and Pepsico. It also manufactures films for industrial applications ranging from lamination film for carpet padding to films used in solar panel construction.

The Company supplies component and packaging films used for personal care applications. Berry is a converter of printed bags, pouches and roll stock. Its manufacturing base includes integrated extrusion that combines with printing, laminating, bagmaking, Innolok and laser-score converting processes. The Company is a supplier of printed film products for the fresh bakery, tortilla and frozen vegetable markets with brands, such as SteamQuick Film, Freshview bags and Billboard . The Company manufactures specialty coated and lami! nated pr!! oducts fo! r a range of packaging applications. Its products are sold under the MarvelGuard and MarvelSeal brands and are sold to converters who transform them into finished goods.

The Company competes with Printpak, Tredegar and Bemis.

Top 10 Paper Companies To Buy For 2015: Graphic Packaging Holding Co (GPK)

Graphic Packaging Holding Company (GPHC), incorporated on June 21, 2007, is a provider of packaging solutions for a variety of products to food, beverage and other consumer products companies. The Company is also a producer of folding cartons and coated unbleached kraft paperboard, coated-recycled board and multi-wall bags. The Company operates in two business segments: paperboard packaging and flexible packaging. The Company�� customers include beverage, food and other consumer products industries. The Company operates in four geographic areas: the United States/Canada, Central/South America, Europe and Asia Pacific. In December 2011, the Company combined its multi-wall bag and specialty plastics packaging businesses with the kraft paper and multi-wall bag businesses of Delta Natural Kraft, LLC and Mid-America Packaging, LLC (collectively DNK), both wholly owned subsidiaries of Capital Five Investments, LLC (CVI). Under the terms of the transaction, the Company formed a company, Graphic Flexible Packaging, LLC (GFP), in which it owns 87% interest. On April 29, 2011, the Company acquired all of the assets of Sierra Pacific Packaging, Inc. (Sierra), a producer of folding cartons, beverage carriers and corrugated boxes for the consumer packaged goods industry. In January 2013, the Company acquired Contego Packaging Holdings, Ltd.

Paperboard Packaging

The Company supplies paperboard cartons and carriers. The Company provides a range of paperboard packaging solutions for various end-use markets, such as beverage, including beer, soft drinks, energy drinks, water and juices; food, including cereal, desserts, frozen, refrigerated and microwavable foods and pet foods; prepared foods, including snacks, quick-serve foods for restaurants and food service products, and household products, including dishwasher and laundry detergent, healthcare and beauty aids, and tissues and papers. The Company produces paperboard at its mills; prints, cuts and glues (converts) the paperboard into fol! ding cartons at its converting plants; and designs and manufactures packaging machines that package bottles and cans and, to a lesser extent, non-beverage consumer products. The Company also installs its packaging machines at customer plants and provides support, service and performance monitoring of the machines. The Company offers a variety of laminated, coated and printed packaging structures that are produced from its coated unbleached kraft (CUK), coated-recycled board (CRB), kraft paper and uncoated-recycled board (URB), as well as other grades of paperboard that are purchased from third-party suppliers. The Company manufactures corrugated medium and kraft paper for sale in the open market and internal use.

Flexible Packaging

The Company�� flexible packaging segment includes multi-wall bags, plastics, labels, and the Pine Bluff, AR mill. The Company is a supplier of flexible packaging in North America. Its products include multi-wall bags, shingle wrap, plastic bags and film for building materials (such as ready-mix concrete), retort pouches (such as meals ready to go), medical test kits, batch inclusion bags and film. Its end-markets include food and agriculture, building and industrial materials, chemicals, minerals, pet foods, and pharmaceutical products. Approximately 27% of the plastics produced are consumed internally. The Company�� label business focuses on heat transfer labels and lithographic labels. The Company operates label plants, which produce labels for food, beverage, pharmaceutical, automotive, household and industrial products, detergents, and the health and beauty markets.

The Company competes with MeadWestvaco Corporation and Klabin Company.

Top 10 Paper Companies To Buy For 2015: Castle (A.M.)

A. M. Castle & Co., together with its subsidiaries, distributes specialty metals and plastics worldwide. The company operates in two segments, Metals and Plastics. The Metals segment distributes engineered specialty grades and alloys of metals, as well as provides specialized processing services. It offers alloy, aluminum, nickel, stainless steel, carbon, and titanium in various forms, such as plate, sheet, extrusions, round bar, hexagon bar, square and flat bar, tubing, and coil. This segment also performs various specialized fabrications for its customers through pre-qualified subcontractors that thermally process, turn, polish, and straighten alloy and carbon bars. The Plastics segment distributes various plastics in forms that include plate, rod, tube, clear sheet, tape, gaskets, and fittings. The company serves Fortune 500 companies, as well as medium and smaller sized firms in the retail, automotive, marine, office furniture and fixtures, safety products, life scienc es applications, general manufacturing, producer durable equipment, oil and gas, aerospace and defense, heavy industrial equipment, industrial goods, and construction equipment industries. It has operations in the United States, Canada, Mexico, France, the United Kingdom, China, and Singapore. The company was founded in 1890 and is headquartered in Oak Brook, Illinois.

Top 10 Paper Companies To Buy For 2015: Meadwestvaco Corporation (MWV)

MeadWestvaco Corporation (MWV) provides packaging solutions to the healthcare, personal care and beauty, food, beverage, home and garden, tobacco, and commercial print industries worldwide. The company?s Packaging Resources segment produces bleached paperboard, Coated Natural Kraft paperboard, and linerboard. Its Consumer Solutions segment designs and produces multi-pack cartons and packaging systems primarily for the beverage take-home and tobacco market. In addition, it offers a range of converting and consumer packaging solutions, including printed plastic packaging and injection-molded products used for personal care, beauty, and pharmaceutical products; and dispensing and sprayer systems for personal care, beauty, healthcare, fragrance, and home and garden markets. In addition, this segment has a pharmaceutical packaging contract with a mass-merchant, and manufactures equipment that is leased or sold to its beverage and dairy customers to package their products. The c ompany?s Consumer & Office Products segment manufactures, sources, markets, and distributes school and office products, time-management products, and envelopes in North America and Brazil through both retail and commercial channels. Its Specialty Chemicals segment manufactures, markets, and distributes specialty chemicals derived from sawdust and other byproducts of the papermaking process in North America, South America, and Asia. Its products include activated carbon used in emission control systems for automobiles and trucks, as well as for water and food purification applications, and performance chemicals used in printing inks, asphalt paving, adhesives, and lubricants for the agricultural, paper, and petroleum industries. MWV?s Community Development and Land Management segment involves in real estate development, forestry operations, and leasing activities. MeadWestvaco Corporation was founded in 1888 and is based in Glen Allen, Virginia.

Advisors' Opinion: - [By Ben Levisohn]

When you’re stock has been lagging the S&P 500, sometimes drastic action must be followed by even more drastic action. Case in point: MeadWestvaco (MWV), which announced a program of cost cutting on the heels of one announced last year.

Top 10 Paper Companies To Buy For 2015: Berry Plastics Group Inc (BERY)

Berry Plastics Group, Inc. (Berry), incorporated on November 18, 2005, is a provider of plastic consumer packaging and engineered materials. Berry owns 100% interest of Berry Plastics Corporation. Berry sells its solutions predominantly into end markets, such as food and beverage, healthcare and personal care. The Company operates in three segments: Rigid Packaging, Engineered Materials and Flexible Packaging. As of September 19, 2012, the Company supplied its customers through 82 manufacturing facilities throughout the United States (68 locations) and select international locations (14 locations). In June 2012, the Company acquired 100% interest of Frans Nooren Beheer B.V. and its operating companies (Stopaq). In September 2011, the Company acquired 100% interests of Rexam Closures Kentucky Inc., Rexam Delta Inc., Rexam Closures LLC, Rexam Closure Systems LLC, Rexam de Mexico S. de R.L. de C.V., Rexam Singapore PTE Ltd., Rexam Participacoes Ltda. and Rexam Plasticos do Brasil Ltda. (collectively, Rexam SBC). In August 2011, Berry acquired 100% interest of LINPAC Packaging Filmco, Inc.

Rigid Packaging

The Company�� Rigid Packaging business consists of containers, foodservice items, house wares, closures, over caps, bottles, prescription vials, and tubes. The end uses for these products are consumer-oriented end markets, such as food and beverage, retail mass marketers, healthcare, personal care and household chemical. The Company manufactures a collection of container products. The Company produces 32 ounce or thermoformed polypropylene (PP) drink cups and offers a product line with sizes ranging from 12 to 52 ounces. The Company�� products of house wares market is focused on producing semi-disposable plastic home and party and plastic garden products. The Company produces closures and over caps across several of its product lines, including continuous-thread and child-resistant closures, as well as aerosol over caps. The Company also provides a range of custom closure ! solutions including fitments and plugs for medical applications, cups and spouts for liquid laundry detergent, and dropper bulb assemblies for medical and personal care applications.

The Company competes with Airlite, Letica, Polytainers, Silgan, Aptar Group and Reynolds.

Engineered Materials

Berry�� Engineered Materials business primarily consists of pipeline corrosion protection solutions, specialty tapes and adhesives, polyethylene-based film products, and can liners served to a variety of end markets including oil, water and gas infrastructure, industrial and consumer-oriented end markets. The Company produces anti-corrosion products to infrastructure, rehabilitation and pipeline projects throughout the world. Products include heat-shrinkable coatings, single- and multi-layer sleeves, pipeline coating tapes, anode systems for cathodic protection and epoxy coatings. These products are used in oil, gas and water supply and construction applications.

Berry is the manufacturer of cloth and foil tape products. Other tape products include range of splicing and laminating tapes, flame-retardant tapes, vinyl-coated and carton sealing tapes, electrical, double-faced cloth, masking, mounting, original equipment manufacturer (OEM) medical and specialty tapes. These products are sold under the National, Nashua and Polyken brands in the United States. The Company manufactures and sells a portfolio of PE-based film products to end users in the retail markets. These products are sold under brands, such as Ruffies and Film-Gard. Its products include drop cloths and retail trash bags. The Company manufactures customized PP-based, woven and sewn containers for the transportation and storage of raw materials, such as seeds, titanium dioxide, clay and resin pellets.

The Company offers range of polyvinyl chloride (PVC) meat film and agricultural film. Berry�� products are used primarily to wrap fresh meats, poultry and produce for supermarket applic! ations. I! n addition, the Company offers a line of boxed products for food service and retail sales. Berry sells trash-can liners and food bags for offices, restaurants, schools, hospitals, hotels, municipalities and manufacturing facilities. The Company also sells products under the Big City, Hospi-Tuff, Plas-Tuff, Rhino-X and Steel-Flex brands. The Company produces both hand and machine-wrap stretch films, which are used by end users to wrap products and packages for storage and shipping. It sells stretch film products to distributors and retail and industrial end users under the MaxTech and PalleTech brands.

The Company competes with AEP, Sigma and 3M.

Flexible Packaging

The Company�� Flexible Packaging business consists of barrier, multilayer film products, as well as finished flexible packages, such as printed bags and pouches. Berry manufactures and sells a range of film products ranging from mono layer to coextruded films having up to nine layers, lamination films sold primarily to flexible packaging converters and used for peelable lid stock, stand-up pouches, pillow pouches and other flexible packaging formats. The Company also manufactures barrier films used for cereal, cookie, cracker and dry mix packages that are sold directly to food manufacturers like Kraft and Pepsico. It also manufactures films for industrial applications ranging from lamination film for carpet padding to films used in solar panel construction.

The Company supplies component and packaging films used for personal care applications. Berry is a converter of printed bags, pouches and roll stock. Its manufacturing base includes integrated extrusion that combines with printing, laminating, bagmaking, Innolok and laser-score converting processes. The Company is a supplier of printed film products for the fresh bakery, tortilla and frozen vegetable markets with brands, such as SteamQuick Film, Freshview bags and Billboard. The Company manufactures specialty coated and laminated produ! cts for a! range of packaging applications. Its products are sold under the MarvelGuard and MarvelSeal brands and are sold to converters who transform them into finished goods.

The Company competes with Printpak, Tredegar and Bemis.

Advisors' Opinion: - [By John Udovich]

One of the most famous scenes in the cult classic, the Graduate, was when Mr. McGuire�took Dustin Hoffman�� character aside and said�"Ben, I want to say one word to you, just one word: Plastics"; but what about the Berry Plastics Group Inc (NYSE: BERY) and its performance verses that of the�iShares S&P 500 Index ETF (NYSEARCA: IVV), iShares Russell Midcap Index Fund ETF (NYSEARCA: IWR) and iShares S&P SmallCap 600 Index ETF (NYSEARCA: IJR)? I should mention that plastics and the Berry Plastics Group was not the place to be yesterday as the stock took a tumble on reduced guidance.

Top 10 Paper Companies To Buy For 2015: Weyerhaeuser Company(WY)

Weyerhaeuser Company, a forest products company, grows and harvests trees, builds homes, and manufactures forest products worldwide. It grows and harvests trees for use as lumber, other wood and building products, and pulp and paper. The company manages 6.4 million acres of private commercial forestland; and has long-term licenses on 13.9 million acres of forestland. It also offers timber; minerals, such as rock, sand, and gravel, as well as oil and gas to construction and energy markets; logs; timberland tracts; and seed and seedlings, poles, plywood, and hardwood lumber products. In addition, the company provides structural lumber products for structural framing; engineered lumber products for floor and roof joists, and headers and beams; structural panels for structural sheathing, subflooring, and stair treading for wood products dealers, do-it-yourself retailers, builders, and industrial users. Further, it offers building products comprising cedar, decking, siding, ins ulation, rebar, and engineered lumber connectors. Additionally, the company offers fluff pulp for use in sanitary disposable products; papergrade pulp for printing and writing papers, and tissues; specialty chemical cellulose pulp for use in textiles, absorbent products, specialty packaging, and high-bulking fibers; liquid packaging board converted into containers; and slush and wet lap pulp for manufacturing paper products. It also constructs single-family houses, as well as develops residential lots and land for construction and sale; and master-planned communities with mixed-use property. The company sells its cellulose fibers products through direct sales network, and liquid packaging products directly to carton and food product packaging converters; and wood products through sales organizations and distribution facilities. Weyerhaeuser Company has been elected to be taxed as a real estate investment trust. The company was founded in 1900 and is headquartered in Federal Way, Washington.

Advisors' Opinion: Top 10 Paper Companies To Buy For 2015: Fibria Celulose SA (FBR)

Fibria Celulose S.A. (Fibria), formerly Votorantim Celulose e Papel S.A., incorporated on July 25, 1941, is a producer of market pulp. During the year ended December 31, 2010, Fibria produced 5,054 kilotons of eucalyptus pulp (including 50.0% of the pulp production of Veracel). The Company also produces coated and uncoated paper, carbonless paper and thermal paper at its Piracicaba paper mill, located in the State of Sao Paulo with an annual production capacity of 190 kilotons. During 2010, it produced 115 kilotons of paper products and recorded consolidated net revenues. Fibria produces bleached eucalyptus kraft pulp at three pulp mills, the Aracruz pulp mill located in the State of Espirito Santo, which has an annual production capacity of 2.3 million tons; the Tres Lagoas pulp mill located in the State of Mato Grosso do Sul, which has an annual production capacity of 1.3 million tons, and the Jacarei pulp mill located in the State of Sao Paulo, which has an annual production capacity of 1.1 million tons. The Company has a 50% interest in Veracel, which owns and operates a pulp mill in the municipality of Eunapolis, State of Bahia, with an annual production capacity of 1.1 million tons.

Pulp

Fibria produces bleached eucalyptus kraft pulp from planted eucalyptus trees. Bleached eucalyptus kraft pulp is a range of hardwood pulp. Eucalyptus is a hardwood tree, and its pulp has short fibers and is generally suited to manufacturing tissue, coated and uncoated printing and writing paper and coated packaging boards. Short fibers are optimal for manufacturing wood-free paper with good printability, smoothness, brightness and uniformity. Market pulp is the pulp sold to producers of paper products. Kraft pulp is pulp produced in a chemical process using sulphate. During 2010, it produced 5,054 kilotons of pulp (including 50.0% of the pulp production of Veracel).

Paper

During 2010, Fibria produced 115 kilotons of paper. The Company produced coated printing an! d writing paper, which is a coated woodfree paper used for promotional materials, folders, internal sheets and cover of magazines, books, tabloids, inserts and mailing; uncoated printing and writing paper, which is a uncoated woodfree paper in reels and sheets; carbonless paper, which is used to produce multi-copy forms, POS, invoices and other applications in place of traditional carbon paper, and thermal paper, which is traditionally used in fax machines; POS, bar code labels, toll tickets, water and gas bills and receipts for automated teller machines (ATMs) and credit card machines. It manufactures thermal paper products with technology licensed byOji Paper Co., Ltd (Oji Paper).

The Company competes with APRIL, Arauco, APP, Georgia Pacific, CMPC, Sodra, Stora Enso, Weyerhaeuser and Suzano.

Advisors' Opinion: - [By Seth Jayson]

Fibria Celulose (NYSE: FBR ) reported earnings on July 24. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended June 30 (Q2), Fibria Celulose met expectations on revenues and missed expectations on earnings per share.

Top 10 Paper Companies To Buy For 2015: Weatherford International Ltd(WFT)

Weatherford International Ltd. provides equipment and services used in the drilling, evaluation, completion, production, and intervention of oil and natural gas wells worldwide. It offers artificial lift systems, which include reciprocating rod lift systems, progressing cavity pumps, gas lift systems, hydraulic lift systems, plunger lift systems, hybrid lift systems, wellhead systems, and multiphase metering systems. The company also provides drilling services, including directional drilling, ?Secure Drilling? services, well testing, drilling-with-casing and drilling-with-liner systems, and surface logging systems; and well construction services, such as tubular running services, cementing products, liner systems, swellable products, solid tubular expandable technologies, and inflatable products and accessories. In addition, it designs and manufactures drilling jars, underreamers, rotating control devices, and other pressure-control equipment used in drilling oil and nat ural gas wells; and offers a selection of in-house or third-party manufactured equipment for the drilling, completion, and work over of oil and natural gas wells for operators and drilling contractors, as well as a line of completion tools and sand screens. Further, the company provides wireline and evaluation services; and re-entry, fishing, and thru-tubing services, as well as well abandonment and wellbore cleaning services; stimulation and chemicals, including fracturing and coiled tubing technologies, cement services, chemical systems, and drilling fluids; integrated drilling services; and pipeline and specialty services. It serves independent oil and natural gas producing companies. The company was founded in 1972 and is headquartered in Geneva, Switzerland.

Advisors' Opinion: - [By Rich Bieglmeier]

And that belongs to William Macaulay who is a director at Weatherford International, Ltd. (WFT). The director bought 78,000 shares of WFT on September 27, 2013 for a total of $1.19 million. Mr. Macaulay's recent purchase is particularly peculiar.

- [By Traders Reserve]

Despite the poor operating performance, things are looking up for Weatherford (WFT) ��that�� why the selling at the start of the year is so perplexing and likely to attract a private equity or hedge fund manager. Analysts expect profits to grow by 58% next year. At current prices, the stock trades for only 11.5 times 2014 estimated earnings. That�� about as cheap as it gets. An astute big boy manager is going to exploit that valuation metric in very short order. I�� get in before they do.

Top 10 Paper Companies To Buy For 2015: Cornerstone Progressive Return Fund(CFP)

Cornerstone Progressive Return Fund is a closed-ended equity fund of fund launched and managed by Cornerstone Advisors, Inc. The fund invests funds investing in the public equity markets of the United States. It invests in stocks of companies operating across diversified sectors. Cornerstone Progressive Return Fund was formed on April 26, 2007 and is domiciled in the United States.

Advisors' Opinion: - [By Dan Caplinger]

But you can see in several places the consequences of the stampede toward high yield. Here are just a few:

Closed-end funds Cornerstone Progressive (NYSEMKT: CFP ) and Pimco High Income (NYSE: PHK ) both make fixed payments back to fund shareholders on a monthly basis, and their distribution yields are truly extraordinary, at about 17% and 12%, respectively. Those dividends have enticed shareholders to pay $1.30 to $1.40 or more for each $1 of assets in the funds. Yet during most months, a substantial portion of those distribution payments has simply been a return of investor capital rather than true income from the funds' investments. A recent study discussed in The Wall Street Journal found that returns on a portfolio with a combined value and dividend-income strategy outperformed a strategy focused more exclusively on maximizing dividends by an average of 1.7 percentage points per year, a huge edge in long-run returns. In the dividend ETF arena, most funds tend to focus on maximizing yield. Although the popular Vanguard Dividend Appreciation (NYSEMKT: VIG ) ETF bucks the trend by screening first for consistent dividend growth and only then looking at yield as a factor, many rival ETFs start with high-yielding stocks as their baseline and only then consider other desirable traits. Others focus solely on high-dividend niches of the market, such as iShares FTSE NAREIT Mortgage-Plus (NYSEMKT: REM ) and its concentration on high-yield mortgage REITs. When dividend stocks get too popular, their prices get out of line with both their dividend income and the fundamentals of the businesses that underlie those stocks. In simpler terms, when dividend stocks become bad values, it's time to consider looking elsewhere for a margin of safety.

Top 10 Paper Companies To Buy For 2015: CenturyLink Inc.(CTL)

CenturyLink, Inc., together with its subsidiaries, operates as an integrated communications company. The company provides a range of communications services, including voice, Internet, data, and video services in the continental United States. Its services include local exchange and long distance voice telephone services, as well as enhanced voice services, such as call forwarding, caller identification, conference calling, voicemail, selective call ringing, and call waiting; wholesale local network access services; and data services, including high-speed Internet access services, data transmission services over special circuits and private lines, and switched digital television services, as well as special access and private line services. The company also offers fiber transport, competitive local exchange carrier, security monitoring, and other communications, as well as professional and business information services. In addition, it provides other related services, such as leasing, selling, installing, and maintaining customer premise telecommunications equipment and wiring; payphone services; and network database services, as well as participates in the publication of local telephone directories. Further, the company offers printing, direct mail services, and cable television services; and wireless broadband Internet access services and satellite television services. As of December 31, 2010, it operated approximately 6.5 million telephone access lines. CenturyLink, Inc was founded in 1968 and is based in Monroe, Louisiana.

Advisors' Opinion: - [By Lauren Pollock]

CenturyLink Inc.(CTL) swung to a steep third-quarter loss as the telecommunications company recorded a $1.1 billion impairment charge tied to its data-hosting segment, while revenue fell for the fifth consecutive quarter. Shares declined 2.6% to $33 premarket.

- [By Selena Maranjian]

Telecom company CenturyLink (NYSE: CTL ) shed 4%, and recently yielded 6.1% (which reflects a dividend cut of about 25% as the company focuses more on share buybacks). The company landed a hefty Pentagon contract in April, with a possible 10-year value of $750 million, and has been moving into promising arenas such as cloud computing (via its purchase of SAVVIS). The company has substantial debt, though, topping $19 billion, but also significant free cash flow, near $3 billion�annually. Its EPS has been rising �in the past few years, but revenue growth is mixed.

- [By Anders Bylund]

So even after all the hacking and slashing, France Telecom's yield is orders of magnitude richer than American contemporaries AT&T (NYSE: T ) and Verizon (NYSE: VZ ) . It's fully comparable to the high-yield payouts of rural American telecoms such as CenturyLink (NYSE: CTL ) and Windstream (NASDAQ: WIN ) , but with the added bonus of growth plans in emerging markets. The French stock strikes a unique balance between generous yields, large-scale operations, and vibrant growth plans.

- [By Mike Deane]

CenturyLink, Inc. (CTL) announced its third quarter earnings after the bell on Wednesday, with core revenues tumbling 1% from last year’s Q3 figure.

CTL Earnings In Brief

-The company announced operating revenues of $4.52 billion, which was slightly above the analyst consensus of $4.51 billion.

-The company’s adjusted earnings came in at $375 million, or 63 cents per share; this is in line with analysts’ EPS estimates.

-CTL gave EPS guidance for the fourth quarter of 55 cents to 60 cents, which is below the 63 cents that analysts are expecting.

-Q4 guidance for revenue is in the range of $4.5 billion to $4.55 billion, which is in line with analysts’ views.

CEO Commentary

Glen F. Post III, the CEO and president of CenturyLink, had the following to say about the company’s quarterly results:

“Overall, we continue to perform well with particular strength in our Business segment where sustained demand for high-bandwidth services and solid sales momentum continue to drive strong results.�Despite this overall solid operating performance in the third quarter, there was a special item which significantly impacted our�financial results�for the quarter. We were required, under GAAP, to recognize a non-cash $1.1 billion impairment to the goodwill assigned to our Data Hosting segment. While we continue to be optimistic and encouraged about the future growth potential and value of our Data Hosting business, we are not currently achieving the forecasted growth and cash flows we originally projected.�As part of our accounting valuation process, past performance was a factor in the development of growth projections for our Data Hosting business in future periods.”

No Mention of Dividend�

CTL did not mention its dividend in the quarterly report, and last paid a dividend on September 19. Look for CTL to declare a dividend in mid-November. The company’s last dividend mov

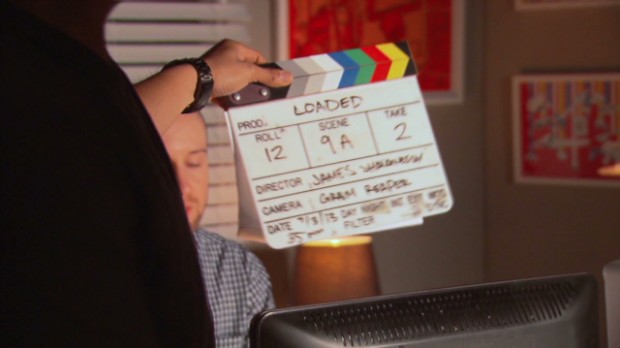

Inside YouTube's new LA studio

Inside YouTube's new LA studio