On Tuesday, Heska (HSKA) hosted its first-ever investor day, during which the management team unveiled significant product and geographic expansion plans (as part of its "Second Act") and provided financial guidance through 2022. Though management's guidance is dependent on the success of the company's new product launches (CEO Kevin Wilson indicated that almost half of the projected growth was derived from new product/geographic expansions), it indicates around a 20% upside from where Heska trades today at $102 per share. The guidance is bullish, but Heska is well-positioned to execute, and the management team's interests appear well-aligned with shareholders'. There are some risks to look out for along the way as the whole space touts high multiples, but the probability of success for Heska looks high.

Growth PlansDuring the investor day, management announced both new product and geographic expansions. Both expansion opportunities are aiming to penetrate large markets, and if successful, will be very significant for Heska (given the company's smaller size).

Product Expansions:

Urine sediment and chemistry analyzer - Q1'19. There was previously quite a bit of speculation that Heska would enter this market, given previous remarks by the management team and the size of the market, and it looks like that speculation was correct. Pet urinalysis is an over $100M market (with around 5 million annual tests) and is likely to continue to grow. Urinalysis is especially important for older pets and is recommended as a once-per-year test. Element F - Q4'19: This is the product that CEO Kevin Wilson was the most excited about. The Element F will mark Heska's entrance into the fecal test space. This is a huge market with over 30 million tests per year (in-clinic, another 10-15M are sent to reference labs) at an average cost of around $18 per test. Currently, these tests are completed manually in a time-consuming process called fecal flotation (which is the gold standard of the industry). Heska believes it can automate this entire process with the Element F. Element I - Q2'19: The Element I is a high sensitivity immunodiagnostics multiplex analyzer. This is another $100M+ market and is a required annual test for dogs and cats. Cloud Data and AI expansion - Q4'18: Heska will be expanding its cloud data and AI capabilities to learn from and leverage the data it collects from its instruments. The company's platform will pull data from imaging, point-of-care lab testing, urinalysis, and fecal testing. Geographic Expansion OpportunitiesHeska also announced its early-stage international expansion plans. The company's current international point-of-care market share is effectively 0%, so there's definitely a lot of room to grow. The two markets management presented an interest in are Australia/New Zealand (Q3'18) and Europe (Q1'19). The Australian market looks attractive for Heska for a couple reasons. First, Australia has more pets per capita than the United States. Second, Heska already has some established logistics channels along with a small install base of instruments in the field that it can leverage. For European expansion, Heska is looking to find a large international partner to enter the market with but will still enter the market if it doesn't find one.

Competitively, Idexx (IDXX) doesn't have the same brand name internationally that it does it the U.S., which should help Heska out in its attempts to gain market share, but as I'll get into a little later, Heska may face some increased competitive pressure from the combined Zoetis (ZTS)-Abaxis (ABAX) entity (assuming the deal goes through). Heska's model is also cheaper than its main competitors and may be more attractive internationally if they are able to successfully enter these proposed markets.

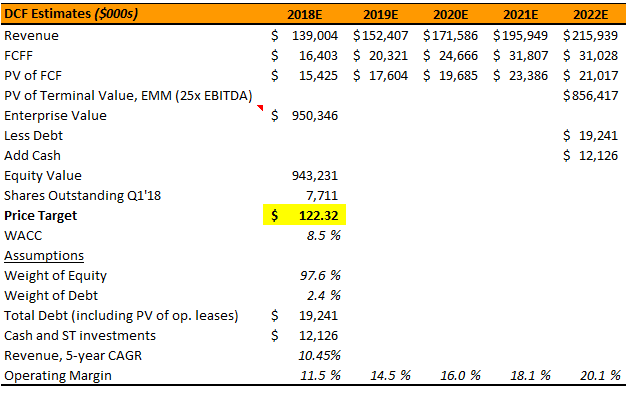

Management Case ValuationIn the investor presentation, management provided guidance on revenue and gross/operating margins for 2020 and 2022.

(Source: 5/15/2018 investor presentation)

When asked by an analyst where most of this growth would come from, CEO Kevin Wilson mentioned that it was split pretty evenly between organic growth and new products/geographies. While this dependence on new product launch successes is more risky than Heska's already established business, the company has a strong track record with 50% of current revenue growth coming from products that have been developed since 2013.

Heska also provided a detailed outlook on key operating costs for 2018 which I included in my model.

(Source: My own chart, data from SEC filings, and the 5/15 investor presentation)

Key Assumptions:

25x EV/EBITDA exit multiple. Heska currently trades around 34x TTM EBITDA, which is less than its peers' median of around 35.3x.

(Source: My own chart, data from GuruFocus and company SEC filings)

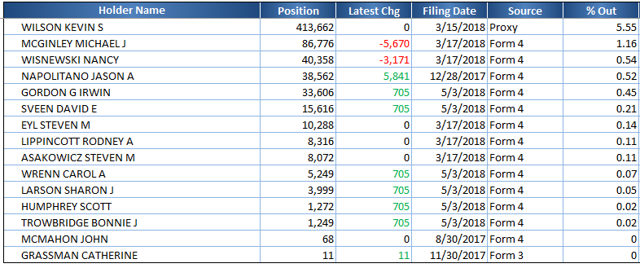

Notably, veterinary giant Zoetis just announced an acquisition of Abaxis for around 39x TTM EBITDA. This boost is also the driver of the increase in the relative valuation output to $109. It's clear that the multiples in the space are high across board, and a 25x exit multiple seems like a conservative discount to today's valuations (especially when we consider Heska's future margin expansion potential). WACC of 8.5%. Adjusted up from a CAPM calculation for a size premium. Growth in operating margins from the maturity and growth in the Rental Reset program, which management revealed details about at the investor day. Some key details were: 4% annual price increases of consumables, estimated 5% increase in pet visits per year at the veterinarian practice level with 15% of those visits needing diagnostics (equating to 75 bps of annual growth) and plans to grow market share and keep renewal rates high with the launches of new products and instruments. Gross and operating margins should begin rapidly expanding in 2019 as Heska's Reset contracts grow and mature. Management guidance turns out to be accurate. Management definitely gave bullish forecasts at the investor day, but I think these are pretty justifiable considering the economics of the Rental Reset program, Heska's competitive positioning in the industry and the sizes of the new markets Heska is entering. Also, the management team has a pretty sizeable stake in the company at 8.95%, with CEO Kevin Wilson owning around 5.5% of the total shares outstanding, which is a promising sign. The stock also has pretty low short-interest (at 3.8% of float), with the only interest really coming from short-ETF/short index-type funds.

(Source: Bloomberg)

M&A ActivityM&A activity in the pet healthcare space has been heating up. In the last few weeks, we have seen two major acquisitions, first, with Heska's partner Henry Schein (HSIC) announcing that they will spin-off their animal health-care business and merge it with Vets First Choice, and second, with Zoetis' $2B bid for Heska's direct competitor Abaxis.

The implications of these moves are multi-faceted for Heska. On one hand, the Henry Schein deal looks like a positive move that may provide Heska with a potential international partnership opportunity. Heska announced that they are looking to expand into Europe through a joint venture, and a partnership with Vets First Choice seems like it would make a lot of sense given Heska's existing relationship and exclusive distribution agreements with Henry Schein.

Looking at the Zoetis-Abaxis deal, the price paid looks positive for Heska with takeout multiples of around 7x TTM sales and 39x TTM EBITDA (after backing Abaxis' cash out of the enterprise value) compared to Heska's current multiples of around 5.8x TTM sales and 34x TTM EBITDA. These multiples assert Zoetis' confidence about the continued growth of the diagnostics space. Zoetis cited international adoption of point-of-care testing/equipment, increasing standards of veterinary care, and the convenience of in-clinic testing as some of the key drivers of growth. Aside from the price of the deal though, this doesn't look too positive for Heska from a competitive standpoint. Zoetis has a global presence with expansive international networks and will most likely ramp-up Abaxis' global growth plans (which are already ahead of Heska's). Zoetis also supplies Heska with its Element COAG product, which is a key product for Heska that is often placed in the field as part of the company's Reset program. The instrument is supplied with a contractual agreement that has been successful for both companies, so it doesn't look very likely that Heska will lose the rights to the instrument, though this very well could affect potential future partnerships between the two companies.

ConclusionHeska has an attractive business model and a strong competitive position within the veterinary diagnostics space, and given the recent run-up in the stock price, it looks like investors are beginning to realize that. Heska has increased its market share from 3% to 10% in the last five years and looks poised to continue its growth streak. Management's projections at the investor day imply around a 20% upside to today's share price, though the projections seem bullish and it may be wise to slightly discount the value of Heska's planned international expansions given Zoetis' entrance. That being said, the management team at Heska is very competent and has a significant stake in the game. The industry is heating up and multiples are riding high, however, Heska trades right around its continuously increasing intrinsic value. Much of the discount to today's intrinsic value has been eroded by the recent share price appreciation, but Heska remains a solid hold.

Disclosure: I am/we are long HSKA.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment