On April 23, prior to Amazon's (AMZN) Q1 results, we wrote an article urging investors to pay attention to Amazon's emerging advertising business, which in my view has been a hidden gem. Sure enough, Amazon's advertising business did not disappoint in Q1 and received increasing attention from analysts. Furthermore, since publishing our article, Amazon's advertising business gained increasing press attention. In this article, armed with new information, I will address some of our readers' questions and update our thinking on the future of this business.

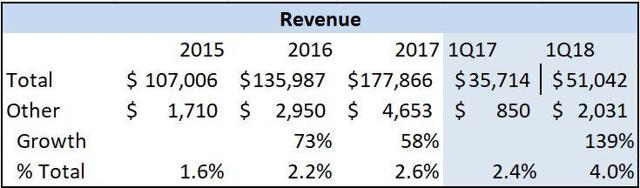

Amazon's Q1 Results Source: ZenAnalyst.com

Source: ZenAnalyst.com

As mentioned in our previous article, I believe that the majority of Amazon's "Other" revenue consists of its advertising revenue and should be used a proxy for that business. A reader asked how I know this, and the answer at the time was simply "I have been following Amazon closely and pieced together various information and used a few assumptions." For those who are unsatisfied with this answer, Amazon's CFO helped me out during this quarter's earnings call by confirming my estimate:

I would say advertising continues to be a bright spot both from a product standpoint and also financially. It continued to be a strong contributor to profitability in Q1. It's now a multibillion-dollar program. You can see the - in our supplemental revenue disclosure, it's in other revenue, and it's the majority of the other revenue in that line item.

So, with that out of the way, and to avoid confusion and simplify discussion, we will henceforth refer to "Other" as "advertising".

There is no little doubt that Amazon's advertising business accelerated strongly in Q1, as advertising revenue grew a record 139% y/y. Note that an accounting change contributed $560M to the "Other" line. Excluding this change, "Other" would have grown 73% y/y, which is of course still a massive number.

Source: ZenAnalyst.com

Source: ZenAnalyst.com

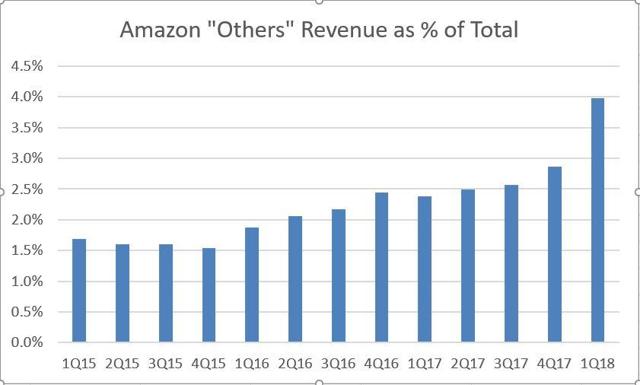

Advertising as a % of Amazon's total business also hit a record 4.0%, which is also the largest sequential increase ever. If the market has not been paying attention before, they better be paying attention now! I'm looking at you, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Facebook (FB) bulls.

Amazon's CFO provided additional color on its advertising business on the earnings call. Below are a few select quotes I believe would aid investors' understanding of Amazon's advertising strategy:

So our philosophy there again is we're continuing to focus on finding valuable ways to make our advertising opportunities better for customers, showing them new products that they may not have seen otherwise and also for emerging and established brands, helping them to reach customers. I think the advertisers generally are all shapes and sizes, and their common theme is they all want to reach our customers generally to drive brand awareness, discovery and eventually purchase.

...

On advertising, so let's step back a bit. It's now a multibillion-dollar program and growing very quickly. Our main goal here is to help customers discover new brands and products. So we show the sponsored products, we're trying to show people things they had maybe wouldn't have seen otherwise in their normal search results. So we're looking for a good balance here, as we said.

We want customers to get the benefit of the new brand and product discovery, and then we want to let sellers for both emerging and established brands, reach those customers. Those advertisers are of all shapes and sizes with the main goal of, again, trying to reach our customers whether it's to drive brand awareness, discovery or hopefully purchase. So, we take the responsibility for that very seriously and are always balancing helpfulness of the advertising and try not to make it disruptive. But you're right, there are always pressures in that. We will come down on the side of the customer. On your question on video advertising, yes, there may be opportunities over time to have more advertising in our Video, but we choose not to do that right now

My take of the above quotes: I am impressed by their consistency of always putting customers first and excited by the prospect of other advertising opportunities such as video and other unstated opportunities such as music, package, and anywhere else in their vast ecosystem that touch customers. Since Amazon's ad load is currently very light, the potential is mind-boggling.

Other DevelopmentsAfter Amazon reported earnings on April 26th, its advertising business gained massive media coverage, receiving coverage from CNBC, Digiday, Adage, Reuters, among others.

On May 4th, Merkle reported that Amazon stopped buying product listing ads from Google. Bloomberg confirmed this report on May 10th, which is how most market participants learned of this intriguing development.

Source: Merkle

Source: Merkle

This is a bold move by Amazon and a strong signal to the market. First, it confirms our thesis that the tech giants are increasing at war with each other as they seek growth. The number of confrontations between Amazon and Google has certainly increased in recent years, and it is an issue we already addressed in a recent article.

The second signal is that Amazon is sufficiently confident in itself to bypass Google all together. And why wouldn't they be confident? According to Survata, in 2017, 49% of US consumers began their online product searches on Amazon vs. 36% of consumers beginning their product search on all search engines, including Google.

Shortly after this news, on May 14th, Bloomberg reported that Amazon is testing a new display ad offering that threatens multibillion-dollar revenue streams at Google and firms like Criteo S.A. (CRTO). According to Bloomberg, "The new tool lets these sellers bid on ads that will appear on other websites and apps, giving them much wider reach."

This is a very interesting development, although one that wouldn't surprise close Amazon observers. Amazon already offers ads that appear on other websites through its Amazon Associates program, the largest affiliated marketing program in the world. To demonstrate how this type of ad works in real life, visit my blog, ZenAnalyst.com, where I set up an "You May Like These" ad for demonstration purposes. You'll notice that the displayed items are the ones that you recently browsed for on Amazon.com. If you click on that ad and make any purchase, the website host (me) earns a small commission.

Although I do not have enough information to make an exact conclusion, this new tool appears to be Amazon's attempt to shift that advertising costs from Amazon to brands.

Concluding ThoughtsThe rapid emergence of Amazon's high-margin advertising business is nothing short of astonishing and reminds me of the emergence of AWS, Kindle, and Alexa, which all seemed to have taken the world by surprise. I believe there is no reason why Amazon's advertising business could not grow to the scale enjoyed by Facebook and Google.

To support this view, I point to the accelerating growth of this business, Amazon's bold moves as highlighted in this article, the increasing concern over Facebook and Google's current duopoly on digital advertising, and Amazon's various advantages over advertising platforms. These advantages include Amazon's 100 million prime members, the fact that significantly more consumers begin their online product search on Amazon than on all search engines (as previously discussed), and Amazon's physical engagement with consumers through its Whole Foods stores, Echo, and packages delivered to customers' homes.

I'm very bullish on Amazon's advertising business and think it should be getting much more attention than it has. What do you think? Let's discuss below! Thank you for reading, and please follow me for future articles.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment